Synopsis

You might be wondering what is an accounting reconciliation and why do I need to do it. This article tries to explain both through easy to understand examples.

What is a reconciliation?

According to Merriam Webster, reconciling means to “make consistent or congruous.” And that’s exactly how you should think about it. A reconciliation is an activity you perform to make your records consistent with your bank’s records. When you reconcile, you will normally need to record transactions that your bank knows about, but you don’t. For example, if you forgot to record your recurring Netflix subscription, once you see it on your credit card statement you can record it. But there will be times when you know about something that your bank doesn’t. For example, when you gave Kathy a check for watching the kids but she didn’t cash the check yet. You know you wrote the check, but your bank doesn’t. You don’t need to do anything in those cases, but that is part of the reconciliation process.

Here’s an easy way to visualize a reconciliation:

You need to record anything your bank knows about that you don’t. Otherwise, you won’t actually know how much mone you have!

My credit card was stolen!

You can probably already see why you need to reconcile. You are not perfect, and you miss things sometimes (like the Netflix bill). But there is another important reason to reconcile: your bank might have made a mistake! Sometimes you will find things like the Netflix subscription that you forgot to record. But sometimes you will find the gas station charge that you never authorized (i.e., fraud). Or you might find the Disney charge that went through twice by mistake. The best way to find these types of mistakes is by recording your own transactions and then reconciling every statement.1 You won’t always find these types of mistakes, but you’ll feel great when you do because you’ll know you are in complete control.

How do I reconcile?

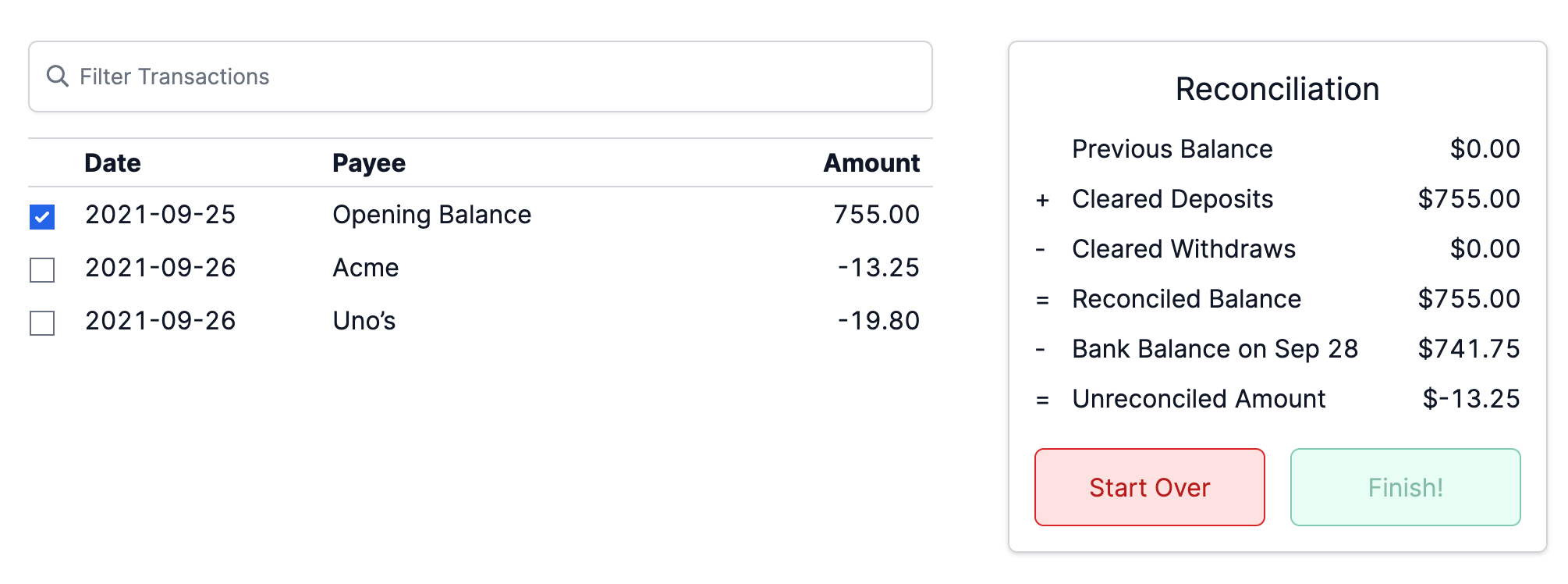

To reconcile an account, click the “Reconcile” button 2. This will bring you to a new screen that looks something like this:

Your goal is to get the “Unreconciled Amount” equal to zero. You will get a popup to set the bank balance the first time you open this form, but you can always change the bank balance by clicking on it (e.g., in the screenshot above you would click the “741.75”) and editing the balance on the popup that shows up.

After you have the right bank balance, you need to go through your list of transactions and make sure that each transaction on your bank statement is checked off in your list. You also need to make sure that no other transactions are checked that are not on your bank statement. In the example above, if my bank statement included the “Acme” transaction, I would check it in Add Rabbit. This would then let me click “Finish!” because my bank balance and my book balance are equal.

If you find any transactions on your bank statement that are not in your list and that you don’t recognize, call your bank! It’s possible that someone made a mistake and you just saved yourself some money.

Tricks to reconcile faster

Here are a few ways you can get through your reconciliations faster:

- Import transactions from your bank instead of doing everything manually.

- Learn how to filter your transactions so that you can isolate transactions quickly (e.g., only deposits, only withdraws, transactions between certain dates, etc.).

- For some banks, it may be easier to only reconcile when you receive a new statement. For other banks, you may be able to reconcile easily whenever you feel like it. Figure out what works best for your banks, then stick to that cycle.

-

I’ve found a few of these types of mistakes over the last few years. One time I saw a recurring charge from our local YMCA for a few months. I thought it was a charge for our daughter’s dance classes, but when we were charged after the classes ended I asked my wife about it. She didn’t know what the charge was, so I contacted the YMCA to find out. It turns out we had been getting charged for someone else’s membership for several months! They gave us a refund immediately. Another time I saw that we were charged by CordBlood 2xs. I contacted them and it turned out they just made a mistake. If I didn’t find these two mistakes, we would have lost over $500 and the YMCA charge could have gone on for many more months! It’s super important to reconcile. ↩︎

-

The reconcile button looks like this: Reconcile ↩︎